HOME BUYING

ASSISTANCE

ASSISTING YOU

TO BUY NEW

Help To Buy

A first-time buyer who is wanting to own a brand new home may need a little bit of financial assistance. The UK Government provide quality financial help for new build homes to ensure the country is providing adequate levels of housing stock and so that you have a choice in the type of property you want to own.

The Help to Buy scheme has helped thousands of people across England and Wales own a new build home with a personal minimum contribution, usually 5% of the overall asking price of the home. The equity loan scheme will fund the remaining required deposit to meet the mortgage providers criteria.

From April 2021 to March 2023 all first time-buyers in England can apply for a government-backed equity loan of up to 20% of the value (40% in London) of all newly built homes.

Help To Buy Wales

Help to Buy Wales is the equity loan provided by the Welsh Government to facilitate financial assistance for new build homes in Wales. This is the Help to Buy facility you would access for one of our homes in North Wales.

Help to Buy is still one of the best home ownership incentives available to first-time buyers in Wales. In a nutshell Help to Buy provide you with an equity loan of up to 20% of the sale price of the home. The means you only need a 5% cash deposit and results in a 25% contribution towards your new home.

Phase 3 of Help to Buy will be available from April 2021 until March 2022 with a cap on homes with a market value exceeding £250,000. Homebuyers will need to meet affordability criteria to borrow the equity loan.

The existing scheme, Phase 2, will close to applications at 5pm on 31st March 2021. For properties to be eligible for Phase 2 funding they must be practically and legally completed by the 23rd December 2021.

Help To Buy

A first-time buyer who is wanting to own a brand new home may need a little bit of financial assistance. The UK Government provide quality financial help for new build homes to ensure the country is providing adequate levels of housing stock and so that you have a choice in the type of property you want to own.

The Help to Buy scheme has helped thousands of people across England and Wales own a new build home with a personal minimum contribution, usually 5% of the overall asking price of the home. The equity loan scheme will fund the remaining required deposit to meet the mortgage providers criteria.

From April 2021 to March 2023 all first time-buyers in England can apply for a government-backed equity loan of up to 20% of the value (40% in London) of all newly built homes.

Help To Buy Wales

Help to Buy Wales is the equity loan provided by the Welsh Government to facilitate financial assistance for new build homes in Wales. This is the Help to Buy facility you would access for one of our homes in North Wales.

Help to Buy is still one of the best home ownership incentives available to first-time buyers in Wales. In a nutshell Help to Buy provide you with an equity loan of up to 20% of the sale price of the home. The means you only need a 5% cash deposit and results in a 25% contribution towards your new home.

Phase 3 of Help to Buy will be available from April 2021 until March 2022 with a cap on homes with a market value exceeding £250,000. Homebuyers will need to meet affordability criteria to borrow the equity loan.

The existing scheme, Phase 2, will close to applications at 5pm on 31st March 2021. For properties to be eligible for Phase 2 funding they must be practically and legally completed by the 23rd December 2021.

Save For Your Home

The Lifetime ISA (LISA) lets you save up to £4,000 every tax year towards a first home or your retirement, with the state adding a 25% bonus on top of what you save. That means you could get a chunky £1,000 of free cash annually. Plus you earn interest on whatever you save, and as it's an ISA, that interest is tax-free. Anybody aged between 18-39 can save the allocated amount every year up until they hit the age of 50.

It is best practice to speak with a financial advisor whilst you are saving the required deposit for a new build home in North Wales. We can help you do this.

£4,000 Per Year

You can use a Lifetime ISA (Individual Savings Account) to buy your first home or save for later life. You must be 18 or over but under 40 to open a Lifetime ISA.

You can put in up to £4,000 each year, until you’re 50. The government will add a 25% bonus to your savings, up to a maximum of £1,000 per year.

Remember both England and Wales Help to Buy equity loans have an interest-free period of five years. After this time accrued interest will be set against the loan and you will continue to pay until you have repaid the full amount. Speak with one of our trained advisors about a new build home in North Wales.

Don't miss out on our future developments in your area

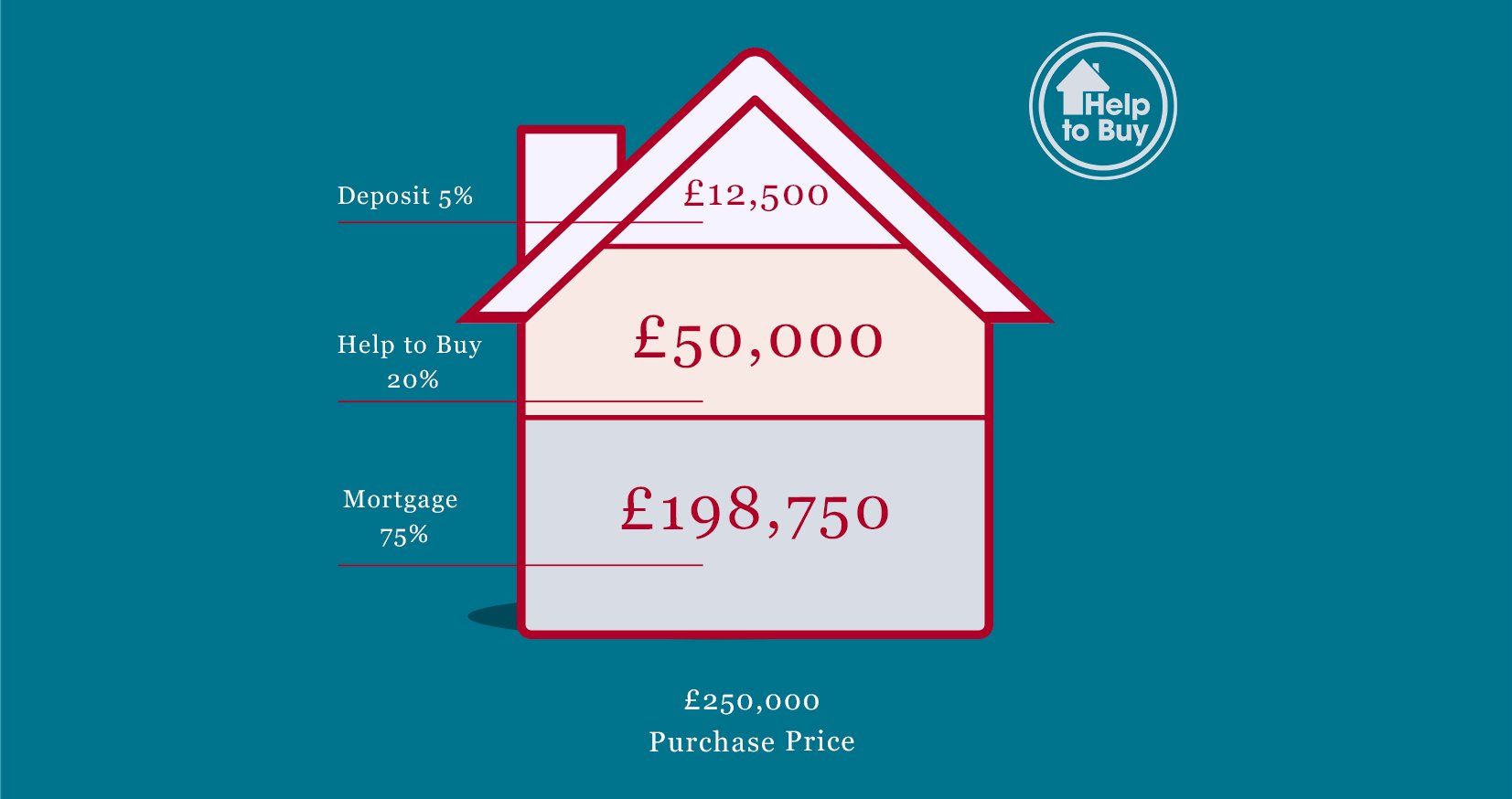

Financial Example

Help to Buy Wales has now introduced a Property market value price capped at £250,000

- You must provide a 5% deposit

- The scheme provides a shared equity loan of up to 20% of the purchase price

- You must take out a repayment mortgage to cover the remaining amount

The shared equity loan needs to be repaid within a total of 25 years. You are free to pay off the shared equity loan at any point within that period. You can repay either a proportion of the loan you received, or the loan in its entirety, without selling the property.

When you buy your home your solicitor will apply for your government bonus on your behalf. The monies from Help to Buy is transferred at the completion of the property.

Save For Your Home

The Lifetime ISA (LISA) lets you save up to £4,000 every tax year towards a first home or your retirement, with the state adding a 25% bonus on top of what you save. That means you could get a chunky £1,000 of free cash annually. Plus you earn interest on whatever you save, and as it's an ISA, that interest is tax-free. Anybody aged between 18-39 can save the allocated amount every year up until they hit the age of 50.

It is best practice to speak with a financial advisor whilst you are saving the required deposit for a new build home in North Wales. We can help you do this.

£4,000 Per Year

You can use a Lifetime ISA (Individual Savings Account) to buy your first home or save for later life. You must be 18 or over but under 40 to open a Lifetime ISA.

You can put in up to £4,000 each year, until you’re 50. The government will add a 25% bonus to your savings, up to a maximum of £1,000 per year.

Remember both England and Wales Help to Buy equity loans have an interest-free period of five years. After this time accrued interest will be set against the loan and you will continue to pay until you have repaid the full amount. Speak with one of our trained advisors about a new build home in North Wales.

Don't miss out on our future developments in your area

Financial Example

Help to Buy Wales

- Property market value price capped at £250,000

- You must provide a 5% deposit

- The scheme provides a shared equity loan of up to 20% of the purchase price

The shared equity loan needs to be repaid within a total of 25 years. You are free to pay off the shared equity loan at any point within that period. You can repay either a proportion of the loan you received, or the loan in its entirety, without selling the property.

Price Matters

Customer Service

We're here to help you throughout your home buying process. Contact us and we will be in touch.

We will get back to you as soon as possible

Please try again later